Polls open across America in a few hours as this article is being published. More than 44 million early voted (372K did in Louisiana), and as this final scorecard is being written for the 2022 midterm election cycle, control of the Senate remains tight, but polling trends have demonstrably been moving in once direction since late August, and one party clearly is in the driver’s seat to retake control of that chamber (as well as the House).

Scorecard Criteria

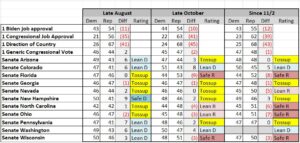

Publicly available polling data for all Senate races has been compiled for November 2-7, and all polling data has since late August been available for JMC’s review. As polling data is compiled for a given time period, it is then averaged for each Senate race, and with the average poll showing for each candidate, here’s how JMC rates each race:

(1) Safe Democratic/Republican – A candidate either has a polling average of at least 50% and/or at least a 10-point lead in the polls;

(2) Lean Democratic/Republican – A candidate has a 3–9-point lead in the polls;

(3) Tossup – A candidate’s lead is less than 3 points in the polls;

JMC’s 11/7 Scorecard

As we move into the homestretch, what’s immediately apparent when comparing polling data in late August to late October data is what’s changed and what hasn’t. The fundamentals (President Biden’s approval, Congressional job approval, and direction of the country) have barely changed in two months.

The one metric that matters the most, however (Generic Congressional Ballot) remains tilted towards the Republicans (it’s currently 48-47% Republican, while in late August it was 46-44% Dem/Rep). At the same time, approval of Joe Biden and Congress have barely moved and remain strongly negative (55-43% disapprove for Biden and 62-23% disapprove for Congress). In other words, those combined fundamental metrics do NOT enable Democrats to offer a compelling message in the final stretch.

Late polling data, however, enables JMC to make three changes: (1) move both the North Carolina and Ohio Senate races from “Leans Republican” to “Safe Republican” (these are both open, Republican held seats), and (2) move the Nevada Senate race (which is held by a first term Democrat) from “Tossup” to “Leans Republican.”

As a result of those changes, the Senate has 4 tossup races, 3 of which (Arizona, Georgia, and New Hampshire) are held by Democrats, while one (Pennsylvania) is a Republican held open seat.

The bottom line: while Democrats have a 50-50 tie in the Senate, post November 1 polling averages show Republicans ahead in 50 seats, while Democrats are ahead in 46 seats. Republicans just need to win 1 of these 4 tossup races for actual control of the Senate, while Democrats need to win all 4 tossups just to maintain control of the US Senate through Vice President Kamala Karris’ tie breaking vote.

The Washington and Colorado Senate races are on the distant radar in terms of being worth watching, but we have not seen polling showing those races moving into the tossup category. Furthermore, these are both 100% vote by mail states, meaning that it’s entirely possibly that a substantial number of votes have already been cast when Democrats were in a stronger electoral position – In Washington, 1773K/37% of registered voters have returned their ballots, while in Colorado, it’s 1340K/31%.

Early voting

Early voting is completed, although mail ballots will still be coming in over the next 1-2 weeks. Currently, we show that 44,235,523 have already voted (372,227 have in Louisiana), and there are easily 5-10 million more mail in votes yet to be counted in multiple states.

Why do these early voting numbers matter ? As mentioned in this analysis, 72% of the vote was cast before Election Day, and even considering that some of that was caused by the pandemic’s changing voting behavior (whether voluntarily or by government decree), JMC believes that there has been a permanent shift to some extent of people wanting to “get it over with” and vote before Election Day. This mindset WILL affect when people are making up their mind about who to vote for, and both candidates/consultants would be wise to take this new paradigm into consideration when planning their messaging/get out the vote efforts.